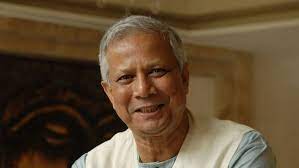

Noble Laureate Muhammad Yunus got Jail

Noble Laureate Muhammad Yunus got Jail

GS-3: Indian Economy

(UPSC/State PSC)

Jan. 04, 2024

Why in News:

Recently, Nobel laureate Muhammad Yunus has been sentenced to six months' jail by a Bangladesh court for violating the country's labor laws.

- Muhammad Yunus is known for introducing the ‘Micro Finance Loan System’ to help the poor people.

- Currently, The 83-year-old, Muhammad Yunus is facing a wide array of other charges involving alleged corruption and fund embezzlement.

Cause of sentenced to Jail:

- A Bangladeshi court found Muhammad Yunus's company, Grameen Telecom, which he founded as a non-profit, guilty of violating labor laws.

- As per the decision, 67 employees of the company should have been made permanent, which was not done and an employee participation and welfare fund was not created.

- Additionally, as per company policy, 5% of the company's dividend was to be distributed to the employees, which was not done.

About Noble Laureate Muhammad Yunus:

- Birth: He was born in the year 1940 in Chittagong, Bangladesh.

- Education: He obtained his PhD in Economics from Vanderbilt University in Tennessee, USA in the year 1969 and then became an Assistant Professor at 'Middle Tennessee State University'.

- After the formation of Bangladesh in 1972, he returned and was appointed head of the Department of Economics at Chittagong University.

- Muhammad Yunus, known as 'Banker to the Poor', won the Nobel prize in 2006.

- On Jan.1, 2024, he was convicted of violating Bangladesh's labour laws and sentenced to 6 months in jail. Notably, Yunus shares a frosty relationship with PM Sheikh Hasina.

Contribution of Muhammad Yunus in the field of Economics

- Idea of Micro Credit: In the post-independence years when Bangladesh was struggling to stabilize its economy and tackle poverty, Muhammad Yunus came up with a unique idea to help the poor.

- He decided to provide small loans at suitable terms to entrepreneurs who generally did not qualify for bank loans.

- Grameen Banks: They established microcredit projects in other parts of the country after the success of the initial local experiment.

- Within seven years this initiative took the formal form of Grameen Bank in the year 1983.

- Grameen Bank is credited with lifting millions of people out of poverty. The system has distributed collateral-free loans worth $34.01 billion among 9.55 million people since its inception.

- Due to the tremendous success of Grameen Bank, banks based on this model are operating in more than 100 countries today.

- In 2006, Muhammad Yunus and Grameen Bank jointly received the Nobel Peace Prize “for their efforts to bring economic and social development to the downtrodden”.

Micro Finance Loan System in India:

- Micro Finance in India is a non-profit organization that provides financial assistance to low-income people. Micro credit, micro savings and micro insurance are examples of these services.

- Micro finance in India are financial institutions that provide small loans to individuals who do not have access to traditional banking services. The term “small loans” is defined differently in different countries.

- In India, it is defined as a loan of less than Rs.1 lakh. Microfinance in India has grown significantly over the past two decades, and now serves accounts (including banks and small finance banks) of approximately 102 million poor people.

- Non-Banking Finance Companies and MFIs in India are regulated by the Reserve Bank of India's Non-Banking Finance Companies-Micro Finance Institutions (Reserve Bank) Directions, 2011.

- The institutions and models related to this are as follows:

- Joint Liability Group

- Self Help Group

- Rural Model Bank

- Rural Co-operation

Significance:

- These institutions easily provide short-term loans to the poor sections, women, unemployed and handicapped people without any collateral.

- These institutions play an important role in increasing the income of poor families and creating employment.

- It provides services to underserved groups of society including women, the unemployed and the disabled.

Source: Indian Express

------------------------------------------

Mains Question:

Highlighting the special contribution of Nobel laureate Muhammad Yunus in the field of economics, mention the significance of micro finance loan system in India.