Surrender Value in Insurance

16.12.2023

Surrender Value in Insurance , Daily Current Affairs , RACE IAS : Best IAS Coaching in Lucknow

|

For Prelims: About Surrender Value in Insurance,How is the surrender value calculated,Types of surrender values For Mains Paper:IRDAI rules for surrender value,Types of surrender values,About The Insurance Regulatory and Development Authority of India (IRDAI) ,functions of IRDA,Important roles of IRDAI |

Why in the news?

The Insurance and Regulatory Development Authority of India (IRDAI), recently released a crucial consultation paper on increasing the surrender value for life insurance policies.

About Surrender Value in Insurance:

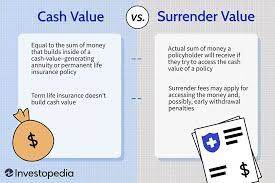

- The surrender value of an insurance policy is the amount that the insurance company will pay the policyholder back when he or she decides to terminate the policy before maturity.

- It applies only to those term insurance policies with a surrender benefit.

- The surrender value is usually a percentage of the total premiums paid minus any applicable charges or fees.

How is the surrender value calculated?

- The surrender value calculation in term insurance policies varies from one insurance company to another. Generally, the surrender value is calculated based on the following factors:

Policy term: The longer the policy term, the higher the surrender value.

Premium paid: The higher the premium paid, the higher the surrender value.

Policyholder’s age: The younger the policyholder at the time of surrendering the policy, the higher the surrender value.

IRDAI rules for surrender value:

- The IRDAI rules say that anyone with a term plan can give up their insurance policy.

- However, only after the policy has been in effect for three years will the policyholder get the payout of the surrender value.

- The IRDAI decides what the policy's surrender value is for the first seven years.

- From the third year on, the surrender value is up to 30% of the paid premium. It excludes the premium paid for the first year.

- Between the fourth and seventh years, the surrender value could fall to up to 50% of the paid premium.

- After seven years, the insurance company decides how much the premium should be.

- The general rule is that the closer you are to your date of maturity when you surrender, the more money and benefits you get.

Types of surrender values

Guaranteed Surrender Value (GSV)

- This is the minimum amount that an insurance company pays to the policyholder upon surrendering the policy.

- The GSV is predetermined at the time of policy purchase and is usually a percentage of the total premiums paid.

Special Surrender Value (SSV)

- This amount is offered at the discretion of the insurance company, over and above the GSV.

- The SSV takes into account various factors such as the policy duration, the number of premiums paid, the current market conditions, and other such factors.

- The SSV is usually higher than the GSV, but there is no guarantee that it will be paid.

About The Insurance Regulatory and Development Authority of India (IRDAI)

- The Insurance Regulatory and Development Authority of India (IRDAI) is an autonomous and statutory body which is responsible for managing and regulating insurance and reinsurance industry in India.

- IRDAI is a 10-member body- a chairman, five full-time members and four part-time members. It was constituted under an Act of Parliament in 1999 and the agency's headquarters is in Hyderabad.

What are the functions of IRDA?

- To safeguard the policyholder’s interest while ensuring a fair and just treatment.

- To have a fair regulation of the insurance industry while ensuring financial soundness of the applicable laws and regulations.

- To frame regulations periodically so that there is no ambiguity in the insurance industry.

Important roles of IRDAI -

- First and foremost is safeguarding the policyholder’s interest.

- Improve the rate at which the insurance industry is growing in an organised manner to benefit the common man.

- To ensure the dealing are carried on in a fair, integral manner along with financial soundness keeping in mind the competence of the insurance company.

- To ensure faster and a hassle-free settlement of genuine insurance claims.

- To address the grievances of the policyholder through a proper channel.

- To avoid malpractices and prevent fraud.

- To promote fairness, transparency and oversee the conduct of insurance companies in the financial markets.

- To form a reliable management system with high standards of financial stability.

Source:Mint