Payment Aggregator Cross Border (PA-CB)

03.11.2023

Payment Aggregator Cross Border (PA-CB) , Daily Current Affairs , RACE IAS : Best IAS Coaching in Lucknow

|

For prelims: New rules of RBI,New instructions of RBI,Payment Aggregator (PA),Important points |

Why in the news?

Recently, new norms have been issued by the Reserve Bank of India (RBI) to regulate cross-border payment platforms.

Important points:

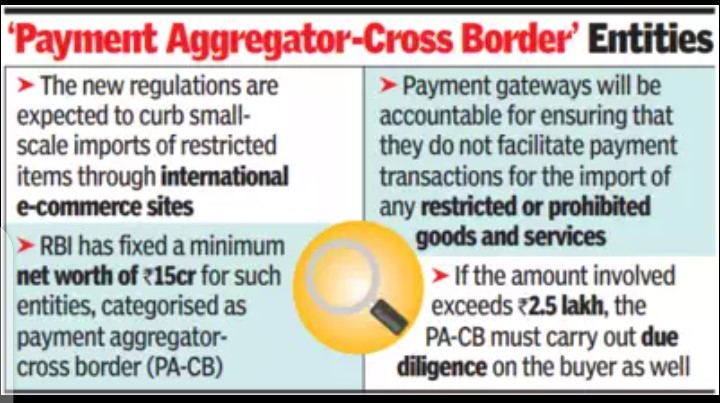

- With cross-border payments on the rise, the Reserve Bank of India (RBI) has now issued regulations to directly regulate entities facilitating such transactions.

- According to a report, the global cross-border payments market is projected to grow to a market size of $238.9 billion by 2027.

New rules of RBI:

- The order was issued under relevant sections of the Payment and Settlement Systems Act, 2007 and the Foreign Exchange Management Act (FEMA), 1999.

- RBI has directed all concerned stakeholders involved in settlement and processing of cross-border transactions for import and export of goods and services, including Authorized Dealer (AD) banks, PAs and PA-CBs, to comply with certain rules and regulations.

- Under this rule, all entities carrying out cross border transactions for import and export of goods and services in online mode will come under its direct regulation and will be considered as 'Payment Aggregator-'Cross Border' (PA-CB).

New instructions of RBI:

- Authorized Dealer (AD) Category-I Banks – They do not require separate approval for PA-CB activity.

- Existing non-banks providing PA-CB services – They will have to apply to RBI for authorization by April 30, 2024 and get registered with the Financial Intelligence Unit-India (FIU-IND).

- Apart from this, RBI has also set the minimum net worth limit at the time of submitting the application at Rs 15 crore.

- By March 2026, RBI mandates that these platforms must have a minimum net worth of Rs 25 crore for authorization to provide such services.

- New Non-Bank PA-CB – They should have a minimum net worth of Rs 15 crore at the time of application and Rs. 25 crores by the end of the third financial year of the authority.

- In case of PA-CB imports, if the per unit of goods/services imported is more than Rs 2,50,000, the concerned PA-CB will also conduct due diligence of the buyer.

- The central bank also warned platforms that those not complying with net-worth rules will have to stop offering cross-border payment services by July 31, 2024.

- Further, except small PPIs, payment for imports can be made using any payment instrument provided by authorized payment systems in India.

- If the import of goods/services per unit exceeds Rs 2.5 lakh, the concerned PA-CB will have to conduct due diligence of the buyer.

- PAs carrying out cross-border transactions must also submit a certificate from their statutory auditor evidencing the net worth.

Payment Aggregator (PA):

- Payment aggregators act as a bridge between e-commerce sites and customers for payment transactions.

- PAs let e-commerce sites and merchants accept various instruments from customers to meet their payment obligations.

- This saves traders from having to build their own systems.

- A typical payment transaction by a customer involves the PA receiving payments from customers, pooling and transferring them to merchants.

Payment Aggregator-Cross Border (PA-CB):

- Entities that facilitate cross border online payments for import and export of permitted goods and services.

Categories of PA-CB:

- Export PA-CB only.

- Import PA-CB only.

Both export and import PA-CB.