Fiscal Consolidation

08.02.2024

Fiscal Consolidation , Daily Current Affairs , RACE IAS : Best IAS Coaching in Lucknow

|

For the Prelims:About Fiscal Consolidation,Key Point |

Why in the news?

Recently, Fiscal Consolidation was emphasized in the budget 2024-25.

Key Point

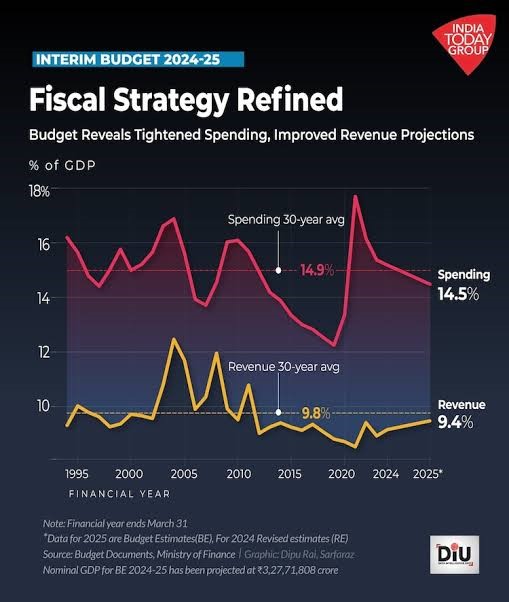

- Union Finance Minister Nirmala Sitharaman announced during her Budget speech that the Centre would reduce its fiscal deficit to 5.1% of gross domestic product (GDP) in 2024-25.

About Fiscal Consolidation:-

- Fiscal consolidation is a process where government’s fiscal health is getting improved and is indicated by reduced fiscal deficit.

- As the fiscal deficit falls below a tolerable level, improved tax revenue realization and better directed expenditure are key components of fiscal consolidation.

In India, the fiscal deficit is the most important indicator of the government’s financial health.

- In India, fiscal consolidation or the fiscal roadmap for the centre is expressed in terms of the budgetary targets (fiscal deficit and revenue deficit) to be realized in successive budgets

- The Fiscal Responsibility and Budget Management (FRBM) Act gives the targets for fiscal consolidation in India.

- According to FRBM, the government should eliminate the revenue deficit and reduce the fiscal deficit to 3% (medium term) of the GDP.

Measures from the expenditure side and revenue side are envisaged by the government to achieve fiscal consolidation:-

- Improved tax revenue realization: For this, increasing efficiency of tax administration by reducing tax avoidance, eliminating tax evasion, enhancing tax compliance etc. are to be made.

- Enhancing tax GDP ratio by widening the tax base and minimizing tax concessions and exemptions also improves tax revenues.

Better targeting of government subsidies and extending the Direct Benefit Transfer scheme for more subsidies.

Source:The Hindu