Financial Intelligence Unit

30-12-2023

Financial Intelligence Unit

|

For Prelims: About the Financial Intelligence Unit India, Constitution of FIU, Virtual Digital Assets For the mains paper :Functions of FIU-IND, Objectives of the FIU |

Why in the news?

Recently, as part of compliance action against the offshore entities, Financial Intelligence Unit India (FIU IND) has issued compliance Show Cause Notices to nine offshore Virtual Digital Assets Service Providers (VDA SPs) under the Prevention of Money Laundering Act, 2002 (PMLA).

About the Financial Intelligence Unit India:

- The FIU- IND was set by the Government of India in 2004 as the central national agency responsible for receiving, processing, analyzing and disseminating information relating to suspect financial transactions.

- FIU-IND is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

Constitution of FIU

- The FIU – IND is a multidisciplinary body with a sanctioned strength of 74 members from various government departments.

- The members are inducted from organizations including Central Board of Direct Taxes (CBDT), Central Board of Excise and Customs (CBEC), Reserve Bank of India (RBI), Securities Exchange Board of India (SEBI), Department of Legal Affairs and Intelligence agencies.

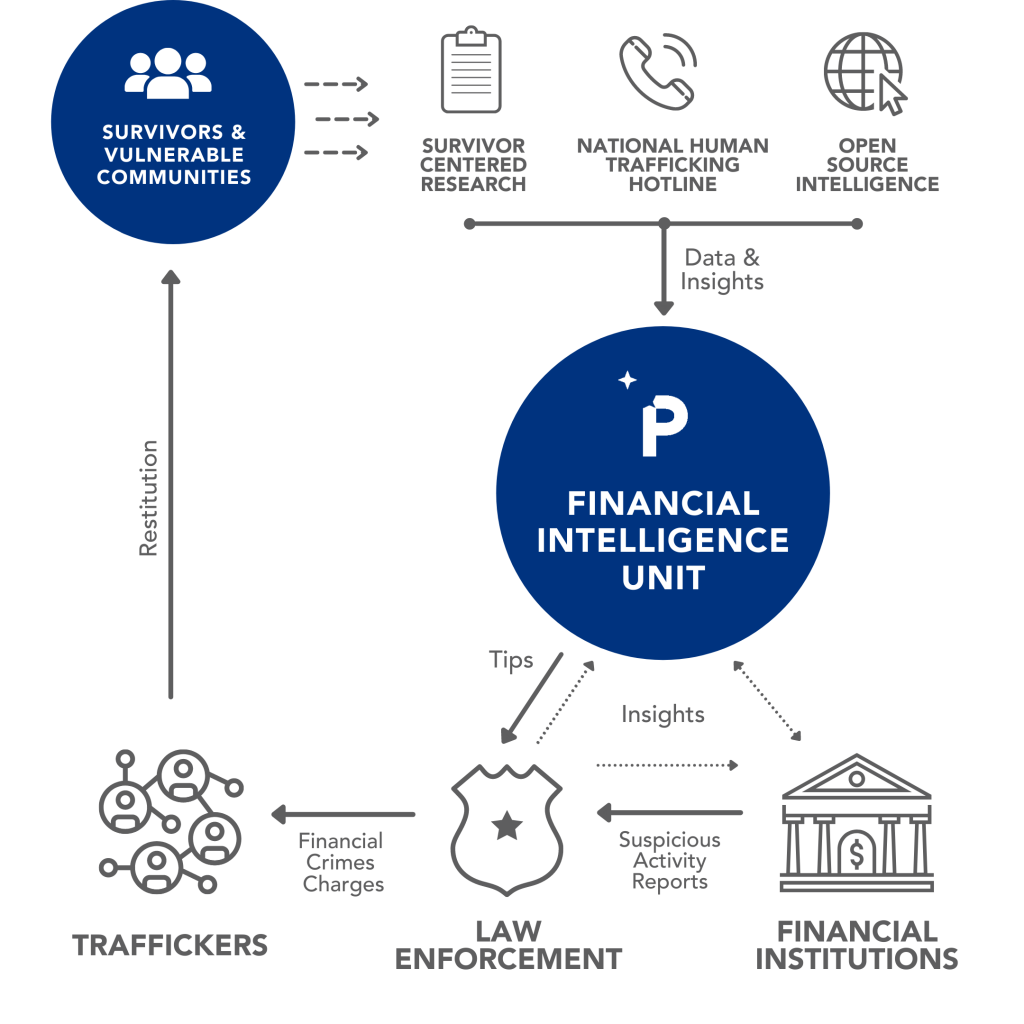

Functions of FIU-IND

Collection of Information: Act as the central reception point for receiving Cash Transaction reports (CTRs), Cross Border Wire Transfer Reports (CBWTRs), Reports on Purchase or Sale of Immovable Property (IPRs) and Suspicious Transaction Reports (STRs) from various reporting entities.

Analysis of Information: Analyze received information to uncover patterns of transactions suggesting suspicion of money laundering and related crimes.

Sharing of Information: Sharing information with national intelligence/law enforcement agencies, national regulatory authorities and foreign Financial Intelligence Units.

Act as Central Repository: Establish and maintain national data base on cash transactions and suspicious transactions on the basis of reports received from reporting entities.

Coordination: Coordinate and strengthen collection and sharing of financial intelligence through an effective national, regional and global network to combat money laundering and related crimes.

Research and Analysis: Monitor and identify strategic key areas on money laundering trends, typologies and developments.

Objectives of the FIU

Objectives of the FIU

- To identify financial transactions and activities that are related to criminal activities such as tax evasion, money laundering, and corruption.

- To report and create Suspicious Transaction Reports (STRs) on suspicious activities and provide analysis of the information received.

- To determine and understand the financing of criminal and terrorist organizations and their methods of operation.

- To share financial information and data collected with other countries through intergovernmental networks, such as the Egmont Group, to enhance global cooperation in the fight against financial crimes.

Virtual Digital Assets

- According to the Income Tax Act, 'virtual digital asset' refers to any information, code, number, or token (not being Indian currency or foreign currency) generated through cryptographic means and blockchain technologies.

- It can be transferred, stored, or traded electronically and its definition specifically includes a non-fungible token (NFT) or any other token of similar nature, by whatever name is called.

Source:PIB