Alternative Investment Funds

21-12-2023

Alternative Investment Funds

|

For Prelims: About Alternative Investment Funds, Important points, Categories of AIFs, Types of Alternative Investments, Who can invest in an AIF?, Benefits of AIF |

Why in the news?

Recently, RBI directed banks to refrain from investing in any scheme offered by Alternative Investment Funds.

Important points:

- RBI has further directed banks to liquidate their investment from such AIFs within thirty days.

About Alternative Investment Funds:-

- It is a special investment category that differs from conventional investment instruments.

- Alternative investment funds (AIF) are effectively non-traditional privately pooled investment vehicles that cater to the funding needs of relatively high-risk ventures across a broad spectrum of the investing universe.

- It pools funds from investors and invests them under different categories of investments as specified by the SEBIfor the benefit of investors.

- The Securities and Exchange Board of India (SEBI), under the SEBI (Alternative Investment Funds) Regulations, 2012 (the “AIF Regulations”) regulates all pooling structures in India, including AIFs.

- AIFs can be formed as a company, Limited Liability Partnership (LLP), trust, etc.

- It is an investment option for high rollers, including domestic and foreign investors in India.

- Generally, institutions and high net worth individuals invest in AIF as it needs a high investment amount.

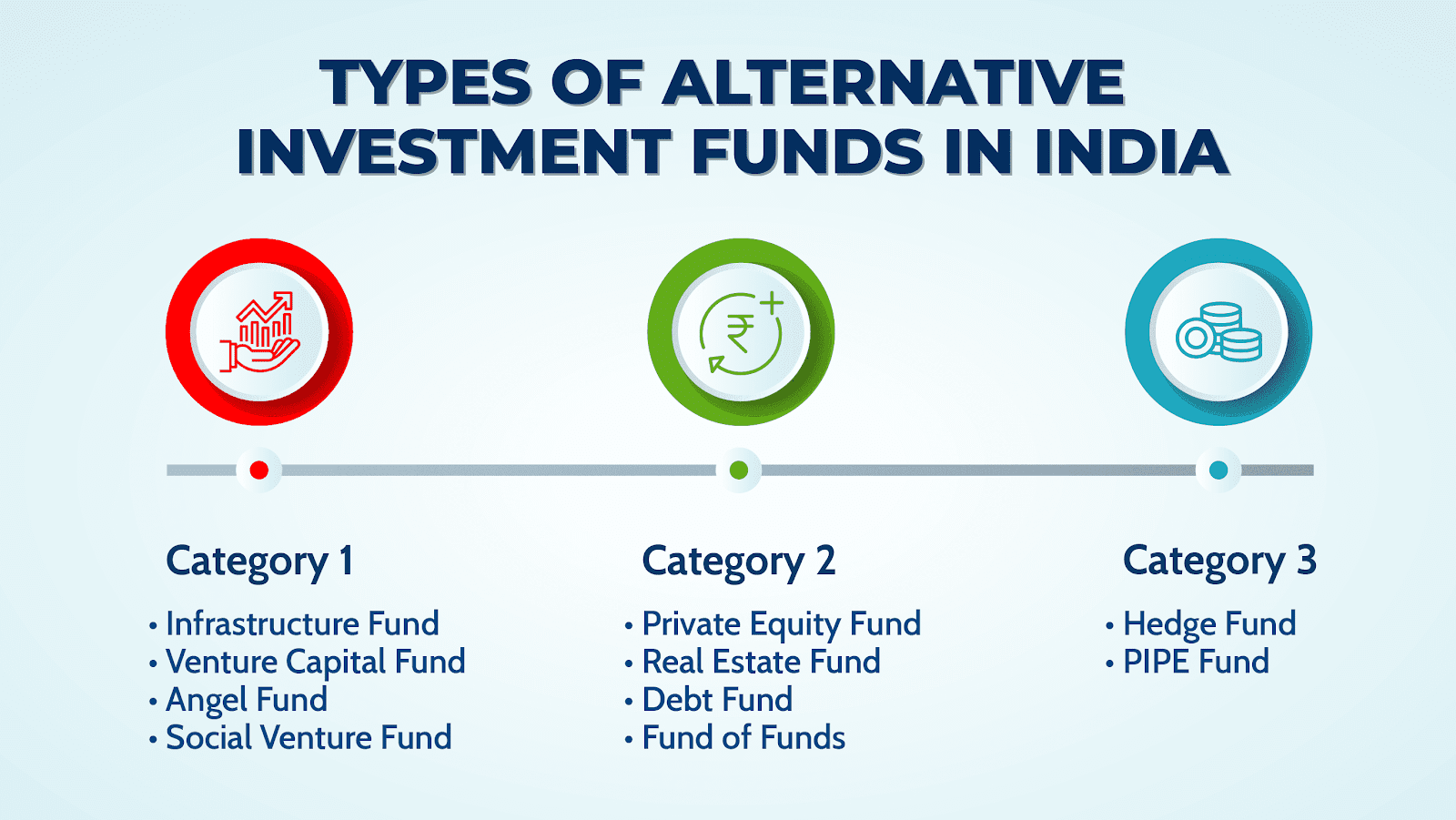

Categories of AIFs:-

- Category I: Mainly invests in start-ups, SME’s or any other sector which Govt. considers economically and socially viable.

Examples of this category are :

Infrastructure Funds

Angel Funds

Venture Capital Funds

Social Venture Funds

- Category II: private equity funds or debt funds for which no specific incentives or concessions are given by the government or any other Regulator.

Examples of this category are :

Fund of Funds

Debt Funds

Private Equity Funds

- Category III: hedge funds or funds which trade with a view to making short term returns or such other funds which are open-ended and for which no specific incentives or concessions are given by the government.

Examples of this category are :

Hedge Funds

Private Investment in Public Equity Funds

Category I and II AIFs are required to be close ended and have a minimum tenure of three years. Category III AIFs may be open ended or close ended.

Types of Alternative Investments

Real Estate

Commodities

Farmland

Art and Collectibles

Cryptocurrencies

Venture Capital/Private Equity

Peer-to-Peer Lending

Who can invest in an AIF?

- Indian Residents, NRIs (Non-Resident of India), and foreign nationals are eligible to invest in these funds.

- Joint investors can also invest in AIF. They can be spouse, parents, or children of investors.

- The minimum investment amount for investors is Rs1 crore for investors. For directors, employees, and fund managers, this limit is Rs 25 lakh.

- Most AIFs come with a minimum lock-in period of three years.

The maximum number of investors in every scheme is capped at 1,000. However, in the case of angel funds, the cap is 49.

Benefits of AIF:-

- Security against volatility – These schemes do not put their funds in investment options that trade publicly. Hence, they are not related to the broader markets and do not fluctuate with their ups and downs.

- Excellent portfolio diversification to a wide array of assets

- Profitable returns – as these funds have numerous investment options, They are a better source of passive income. Further, returns are less prone to fluctuations as these schemes are not linked to the stock market.

Source: News on Air