Ukraine’s Minerals Gamble: Strategic Resources as Leverage in a War Economy

Ukraine’s Minerals Gamble: Strategic Resources as Leverage in a War Economy

On April 30, 2025, Ukraine and the United States signed a historic agreement granting Washington access to Kyiv’s vast mineral reserves. Touted as a partnership of equals, the deal is part of Ukraine’s larger “victory plan” aimed at sustaining its war effort and post-conflict reconstruction. However, beneath the rhetoric of economic cooperation lies a stark geopolitical reality—this is not just a resource deal, but a high-stakes gamble in wartime diplomacy.

The Anatomy of the Deal: Access for Investment

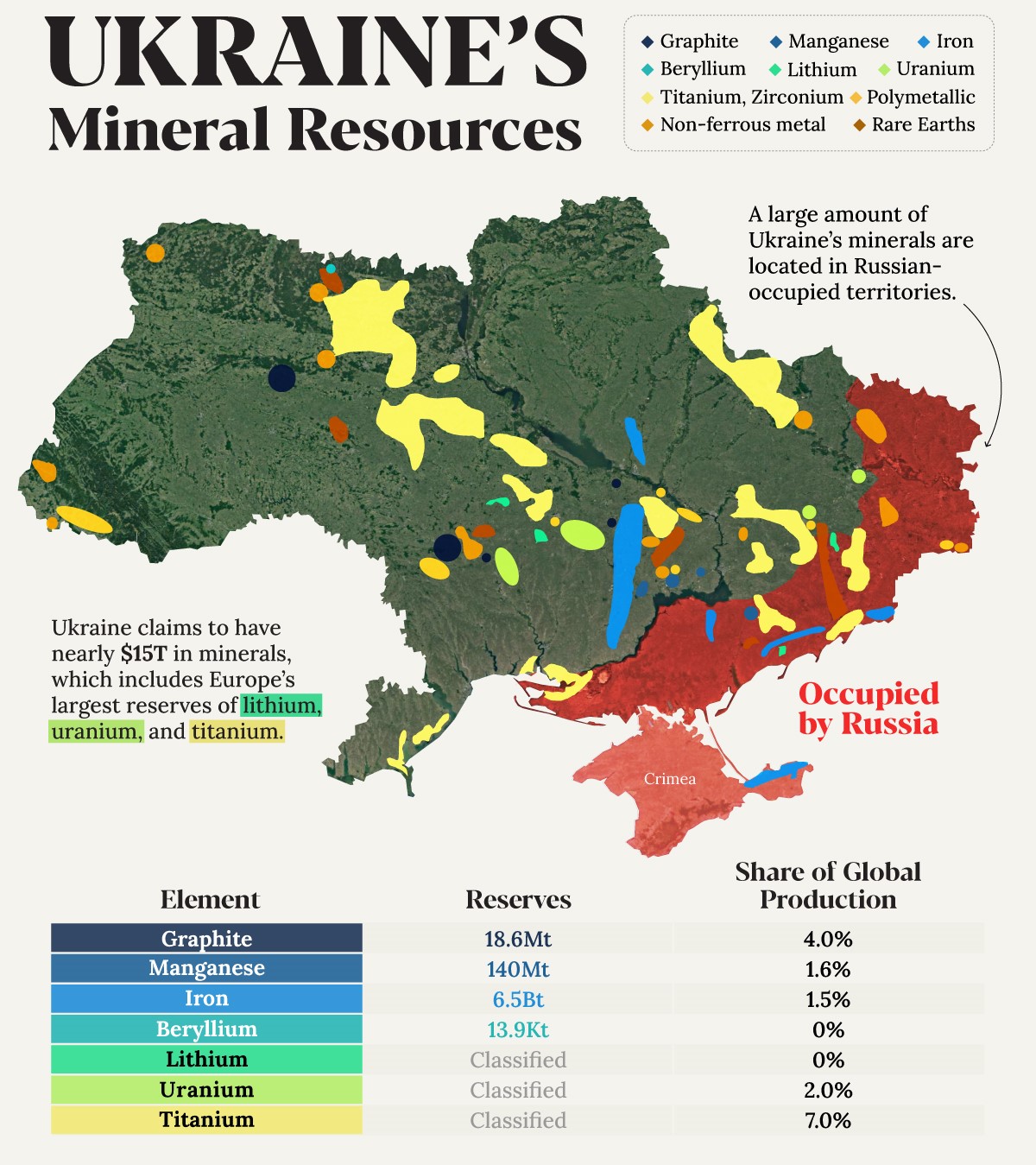

At the heart of the agreement is a joint investment fund—The United States-Ukraine Reconstruction Investment Fund. Through this vehicle, U.S. companies will be allowed to invest in Ukraine’s critical mineral extraction industries. The minerals in question—lithium, titanium, graphite, uranium, and rare earth elements—are essential for sectors ranging from defense and aerospace to green energy.

In exchange, Ukraine will receive investment-linked military support, a shift from traditional grant-based aid. Importantly, while the deal avoids framing past U.S. assistance as debt, future military aid will be considered capital input into this fund. Kyiv is obligated to share 50% of its revenues from these mineral projects with the fund, effectively tying battlefield survival to subsoil wealth.

A Diplomatic Tightrope: No Security Guarantees

One of the most telling aspects of the deal is what it omits—firm U.S. security guarantees. Despite Ukrainian President Volodymyr Zelenskyy’s initial pitch positioning the minerals agreement as a gateway to long-term protection from Russian aggression, no NATO-style assurances have been offered. In essence, while minerals flow westward, Ukraine must still fight its war without concrete defense commitments.

This is a calculated compromise. For Ukraine, the priority is survival. With U.S. domestic politics growing hostile to continued military expenditure abroad, the deal serves as a workaround to ensure continued American involvement—albeit via economic, not military, channels.

Strategic Context: The U.S. Bids for Mineral Independence

For the United States, the deal offers far more than just an opportunity to support an ally. It is part of a broader effort to reduce reliance on China for critical minerals. China currently dominates global production and processing of rare earths and battery minerals — an uncomfortable dependency for Washington’s clean energy transition and defense manufacturing.

By tapping into Ukraine’s largely untapped reserves, the U.S. not only diversifies its supply but gains a geopolitical foothold in the resource diplomacy of Eastern Europe. This is particularly valuable in a world increasingly shaped by strategic resource competition rather than mere trade.

Kyiv’s Weak Bargaining Position

While Ukrainian officials have portrayed the agreement as a “truly equal” partnership, the finer print tells a more sobering story. Previous drafts of the deal had included clauses that would have granted U.S. companies veto power over future contracts and exclusive rights to resource blocks. Though these were eventually dropped, the final agreement still prioritizes American commercial access.

Ukraine had little choice but to concede. Facing dwindling ammunition stocks, mounting economic pressures, and an uncertain U.S. political landscape—especially with former President Donald Trump back in office—Zelenskyy’s administration is operating under extreme duress. The agreement reflects a classic wartime tradeoff: short-term lifeline for long-term leverage loss.

Rewriting the Rules of Wartime Diplomacy

This minerals deal may become a blueprint for how developed nations support conflict-ridden allies in the 21st century—not through unconditional aid, but through transactional, resource-backed agreements. It represents a fusion of foreign policy, economic interest, and defense strategy.

If successful, the model could be replicated in other geopolitical flashpoints—from Africa’s Sahel region to parts of Southeast Asia. But it also raises uncomfortable questions: Are we entering an era of neo-resource diplomacy where survival comes at the cost of sovereignty?

The Role of Parliament and Civil Society

For the agreement to be fully implemented, it must be ratified by Ukraine’s Parliament. Early indications suggest that ratification won’t be smooth. Several lawmakers and civil society organizations have voiced concerns about transparency, environmental impact, and the long-term implications of granting preferential rights to foreign entities during wartime.

While the government insists that Ukraine retains full control over its resources and that only “preferential” and not “exclusive” rights have been granted, opposition critics argue that the fund structure creates a de facto control mechanism. The debate is likely to become a focal point in upcoming parliamentary sessions, with sovereignty and economic independence dominating the discourse.

Environmental and Social Risks

The rapid expansion of mining operations in a country already devastated by war could have dire environmental consequences. Ukraine's regulatory institutions are currently stretched thin, and oversight mechanisms for foreign-led extraction projects remain underdeveloped.

Moreover, mining often brings local displacement, land degradation, and water contamination. Without robust environmental safeguards, the minerals deal could aggravate public distrust, particularly in regions that bear the brunt of resource extraction but see little of its benefits.

The Trump Factor and Future Uncertainty

One of the most volatile variables in the deal’s future is the U.S. administration itself. The agreement comes at a time when Donald Trump has returned to the White House with a radically different approach to foreign policy. His earlier proposals had demanded Ukraine repay past aid with resource access—an approach that nearly derailed negotiations and led to a public spat with Zelenskyy.

Although the final deal softens those terms, there’s no guarantee the Trump administration will remain committed to the partnership if the war drags on or U.S. domestic opinion shifts. Ukraine's gamble hinges not only on battlefield success but also on political continuity in Washington.

A Fragile Lifeline, Not a Panacea

At its core, the U.S.-Ukraine minerals agreement is a temporary fix — a politically palatable way for the U.S. to stay involved in Ukraine without direct military escalation. It gives Kyiv breathing room but not a strategic breakthrough. The absence of explicit security guarantees means the war effort remains vulnerable to shifting geopolitical winds.

For Ukraine, the deal must be seen as a bridge, not a destination. It buys time to stabilize the economy, maintain foreign support, and continue its push for NATO and EU integration. But it also underscores a harsh reality: in the arena of global politics, natural resources are not just economic assets—they are bargaining chips.

Conclusion: High Stakes in the Shadow of War

Ukraine’s minerals gamble is a bold move born of necessity. It reveals both the ingenuity and the desperation of a nation fighting for its survival. The deal could indeed offer economic uplift and continued U.S. engagement, but it also comes with strings—some visible, others hidden.

Whether this partnership evolves into a model of equitable development or a cautionary tale of wartime compromise will depend not just on what’s written in the agreement—but on how the war unfolds, how the global power balance shifts, and how Ukraine navigates the razor’s edge of sovereignty and survival.